01 | Introduction

Clients, people who read my blogs and newsletters, and those who participate in my training all know that I firmly believe that philanthropy starts with gratitude. Alas, that is the one thing that seems to always get lost.

I think of gratitude as “And then?” — those actions that happen after a person says yes. It’s what you do once the gift is given.

THESE ARE DONOR RETENTION STRATEGIES AND THEY ARE CRITICAL FOR KEEPING YOUR DONORS HAPPY.

Keeping donors happy is just plain good sense. A happy donor is likely to become a donor again. And again. Unhappy donors, however, are likely to become lapsed donors. That is the 60% or so of donors who never make a second gift to an organization or the 30% who fall away each year.

That’s a tremendous waste of time and effort. It’s also not a good way to build a successful fund development department or a sustainable nonprofit.

THE FOCUS OF THIS BOOK IS STEWARDSHIP. BY THE TIME YOU REACH THE LAST PAGE, YOU WILL KNOW:

- What, exactly, is stewardship?

- Why does it matter?

More than that, you’ll be able to ensure that donor retention strategies are an integral part of your development agenda. Indeed, you’ll see how stewardship can be used to create a more effective fundraising program.

02 | What Is Stewardship?

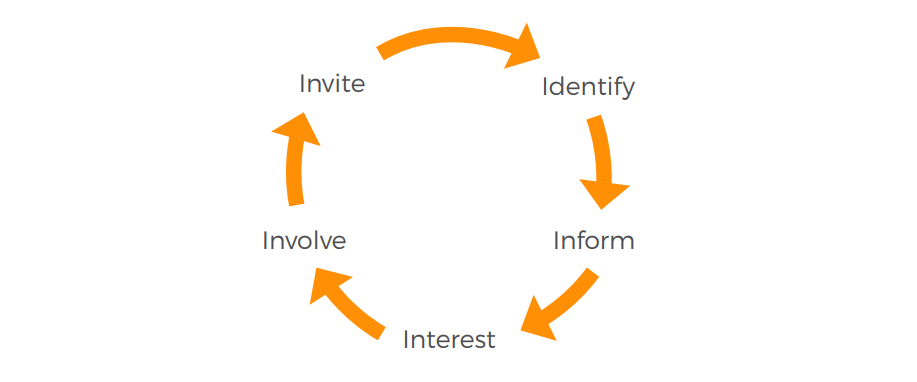

When I first became a fundraiser, I learned about the five I’s of fundraising:

- Identify

- Inform

- Interest

- Involve

- Invite

And when I started doing workshops, I illustrated the five I's like this:

But something always bothered me. Everything seemed to start and end with that ask (the “invite” to invest). The focus was on the gift. And nowhere was their space for what should be happening beyond the gift.

THAT SOMETHING, OF COURSE, IS STEWARDSHIP. So I changed the model:

I like this one better for a couple of reasons:

- The focus is on the donor, which is where it always belongs

- Stewardship is as important as prospecting, cultivating, and yes, soliciting.

DEFINING STEWARDSHIP

I’ve mentioned the word “Stewardship” quite a bit. Indeed, it’s a word that appears prominently in this eBook’s title. But what, exactly does it mean?

Merriam Webster’s dictionary defines stewardship as “the conducting, supervising, or management of something; especially: the careful and responsible management of something entrusted to one’s care.”

Let’s translate that into fundraising-ese. “Careful and responsible management” can change the way you look at fundraising. It can help to ensure that your organization has a large and growing pool of happy and involved donors.

That, of course, will translate into a successful and sustainable nonprofit organization. To do that means you must have clear donor retention strategies.

STEWARDSHIP’S IMPACT

A good friend of mine recently volunteered at a local nonprofit’s annual “Walk for our Cause” event. She secured a number of gifts for the event, helped to organize, and then cover the sign-in desk. She spent the entire day making sure that things went well. Then she stayed after the event to assist with the clean-up.

Six weeks after the event, we ran into each other at a large gathering. She was upset and angry and extremely vocal. This organization that she was so passionate about, where she gave freely of her time, her talents, and her money — as she told the entire room — had not bothered to thank her for her work on the event.

“That’s the last time I’ll do anything for them,” she fumed.

If it had stopped there, the organization would have lost a dedicated supporter. But it didn’t stop there. Unlike me, she didn’t let the organization stay incognito. She loudly told everyone who they were and why they did not deserve anyone’s involvement. Bottom line? I’d be surprised if anyone who heard that story becomes or remains a donor.

My friend, like most people, will tell one or two people about a good experience. But she’ll tell anywhere from six to 20 about something negative. That’s human nature. It’s not that we mean to be negative, it’s just that bad stories are so much more interesting than good ones.

CUSTOMER SERVICE (AKA: DONOR RETENTION STRATEGIES!)

We delight in telling others our horror stories — but we really don’t want to go through the misery again. So we will avoid restaurants where we had bad service or lousy food; stores where the salespeople were not knowledgeable or unhelpful — and nonprofit organizations who didn’t treat us well and make us feel that the gift we made had any meaning.

In the for-profit world, this is called customer service. There are many ways to define what customer service is; most importantly, however, it is the many ways a business treats its customers before, during, and after a sale.

Although many development professionals balk at the notion that what they do is a type of sale, I doubt that anyone in a people business — which development most certainly is — would have a problem in recognizing the need for good relationships. And these actions don’t have to just be about a gift.

Stewardship, like customer service, works to ensure that our donors have good experiences. But it’s more than that. Stewardship also works to ensure that donors continue to be donors and supporters of your organization and your cause.

03 | Why Does Stewardship Matter?

A number of years ago, I was doing a workshop on Building a Donor Pool. There were Executive and Development Directors from 35 discrete organizations.

“It’s so frustrating,” one of the participants said. “We get a donor, but then we never get another gift.”

I looked around the room and saw a lot of nodding heads.

“How many of you,” I asked, “send a thank you letter to every single donor for every single gift, regardless of size?”

Two hands immediately shot up. The rest of the class looked around and several more slowly raised their hands. You know those people were lying.

“I’m a grandmother,” I told them and there was more to the story than just bragging rights. “For my oldest grandson’s birthday last year, I sent a really nice gift. Weeks and weeks and weeks went by and I heard nothing from him or my daughter about the gift. Not an acknowledgment that he got the gift; not a thank you for the present, nothing.”

“His birthday is in October. December rolled around. And I gotta tell you — I really didn’t want to buy my grandson another present for Christmas.”

The point of this, of course, is not that I’m a cheapo and you should be glad I’m not your grandma; the point is that if I felt that way about my grandson what do you think your donors feel about not getting a thank you from your organization?

Not thanking your donors is not a smart donor retention strategy!

STEWARDSHIP STEP #1:

Seems pretty basic, but clearly, not all nonprofits have gotten the message: Make sure you send a thank you to every single donor for every single gift regardless of size.

GIFT ACKNOWLEDGEMENT

Within 48 hours of receiving a gift — any gift, any size — make sure you send an acknowledgment, telling the donor that you have received their gift.

If the gift is for $250 or more (though truth be told, it doesn’t hurt to do this for smaller gifts) in order that the donor can take a tax deduction, the acknowledgment must contain a substantiation statement.

The IRS requires that this substantiation statement be made “contemporaneously” — that is, at the time the gift was received. This statement says that no goods or services were received in exchange for this gift and, therefore the entire amount is tax-deductible.

If, as a result of the donation, something of substantive value was given in return, then your acknowledgment is actually a statement of quid pro quo. These statements are required for contributions of $75 or above and must tell the donor the Fair Market Value (FMV) of the good or service.

The available tax deduction for this is the difference between the donation and the FMV (the price at which property would change hands between a willing buyer and a willing seller, neither having to buy or sell, and both having reasonable knowledge of all the relevant facts).

While it is the donor’s responsibility to get a substantiation statement (but that would not be a good donor retention strategy — you should be responsible for providing it), the quid pro quo is your responsibility and failure to tell donors can result in a hefty fine.

REMINDER | The IRS requires that this substantiation statement be made at the time the gift was received.

STEWARDSHIP STEP #2:

Within 48 hours of receiving a gift, send an acknowledgment providing the information needed for a donor’s tax deduction.

BUT DON’T STOP THERE.

Make sure you also send personal thank you letters to your donors. While I recommend doing that for all donors, you may opt to do that for donors whose gifts are over a certain amount.

Depending on a few things like the size of the gift, frequency of giving, whether this is a first-time gift, the letter should be signed by the Executive Director or CEO, Board Chair or Board Member, or some other notable person at or connected with your organization.

Just as I think the development director should never sign an appeal letter, I also think that this “official” thank you should never be signed by the development director. They can certainly write another thank you (you can’t say “You are wonderful” too many times!) to someone they have developed a relationship with. In fact, I would encourage that. It’s an important donor retention strategy!

STEWARDSHIP STEP #3:

In addition to that acknowledgment, within a week of receiving a gift, a heartfelt and personal thank you letter signed by an appropriate person should be sent to the donor.

You are not done yet! Four to six months after receipt of first-time and larger

gifts, send another thank you that ties the gift to some specific outcome:

“Dear Donor(s): I wanted to circle back to thank you again for the gift you sent some months ago. Because of your generosity, we have been able to….”

Obviously, not every gift is going to have a specific and immediate impact, but so what? What are you doing on a regular basis that you might not be able to do unless you received charitable gifts from your donors? Tell them about those things.

Telling your donors how their gift impacts your work is a great way to keep a donor involved and interested in your organization. And those are two really important factors in getting gifts.

Unless a donor has a good reason to believe that the money they gave you made a difference, it will be harder for that person to make a second gift. Indeed, many donors never ever make that second gift.

STAY CONNECTED | Keep a donor involved by telling them the impact of their gift.

STEWARDSHIP STEP #4:

Some months after receipt of a gift, circle back and again thank the donor, telling them about the impact of their support.

04 | Donor Attrition

In the United States, less than half of donors who made a gift in one year make a repeat gift the next.

While it is true that larger organizations have less attrition than small ones, losing donors is a problem for all of us. Getting new donors — or at least new gifts to offset the loss of your donors — may not be the most feasible solution to the problem.

For over 40 years, charitable giving in the US has equaled approximately 2 percent of gross domestic product (GDP). While there have been slight ups, there have also been slight downs. But the emphasis is on the word “slight.” As a sector, we are not growing—which means that at this moment, there is a finite amount of gift dollars you can get.

Given this reality, the best defense is to keep as many donors as you can — and to keep those donors close and happy.

HOW DOES YOUR ORGANIZATION FARE?

Look at annual giving at your organization over the past three years and answer the following questions:

- How many donors who gave you a gift three years ago, gave a gift two years ago?

- How many of those gave you one this past year?

- Of those who have given to you at least two out of the last three years, how many of the gifts went up? By how much?

- How many went down By how much?

- How many stayed in the same place?

- How many donors who made the first gift last year made one this year?

- How many new donors have you gotten this year?

Are you happy with your answers? Unless yours is an extraordinary organization, I’m going to guess your answer is “not so much.” What, then, do you need to do to improve your situation?

While external forces, especially the economy, will impact your donations, the way you treat your donors will impact their behaviors even more.

WHY DONOR RETENTION STRATEGIES PAY OFF

Keeping your existing donors just makes solid economic sense. Donor retention strategies increase the economic value of fundraising for the simple reason that it costs 7 to 10 times less to get a follow-on gift than it does to get a new one.

Think about it. You’ve already put in the time and effort to identify and find out about your existing donors. Even if your research is at the most basic level, these are real expenses that have to be factored into the cost to raise a dollar. Beyond that, some work has been done to get the donor’s attention.

There’s real cost — both in time and in hard cold cash — to make someone sit up and listen. But once you have their attention, you may never again need to expend as much energy in order for that donor to notice you.

Best of all, that person has already said yes once. They are far more likely to say it again — if you have made sure that the experiences surrounding that yes have been positive. But be proactive. If you lose a donor, think about what you can do to bring that donor back. And remember, stewardship saves you money. It also helps to ensure that you get a bigger bang for your buck. Loyal donors — which is mainly what stewardship tries to ensure—make larger gifts.

STEWARDSHIP STEP #5:

Track your donors. When one lapses — gives one year but not the next — reach out to see if you can bring that donor back in.

05 | Defining Your Donor Retention Strategies

A strategy is a broad plan of action to meet a specific or set of goals. Defining your donor retention strategies means planning for the larger picture of what you will do to steward certain groups of donors.

VERY LARGE NONPROFITS OFTEN HAVE AN ENTIRE DEPARTMENT CONCERNED WITH DONOR RELATIONS.

But for most nonprofits, donor relations is simply another part of the job of the development director. Because donor retention is so important, it is critical that you have clarity about how you are going to steward your donors. That means a plan — in writing!

Considering your resources, therefore, must be the first step of defining your stewardship strategy. It does you no good to have great ideas that

would bring donors closer to the organization if you don’t have the people or

financial power to follow through.

Once you are clear about the resources, then you need to define your baseline stewardship strategies. That is—what you are going to do on a regular basis for every single donor and donor group. Included in this would be those acknowledgments and thank you letters. This becomes part of your regular workload.

SPECIAL STEWARDSHIP ACTIVITIES

The next steps are those “special” activities that you develop for specific donors or donor groups. For example, donors who are members of a giving circle or gift club, major donors, first-time donors.

You may decide those appropriate stewardship strategies for donors who give $250 or less a year would be what I’ll term “group stewardship steps.” By that I mean what one in the group gets, all will get. Donors at the $1,000 or more level will get more individualized activities.

Of course, depending on the size and sophistication of your development program, you may be adding or subtracting zeros to my examples.

STEWARDSHIP STEP #6

Connect the dots. Try to develop as many steps as possible that will make your donors feel good about what they have already done while moving them toward a follow-on gift.

One important way to do this is to use stewardship as a step to move donors from one group (for example, annual donors) to another (planned givers).

One of my clients did just that. They were starting a planned giving program. Most bequests come from the ranks of annual donors. Remembering that stewardship and cultivation are just different sides of the same coin, we invited their $250 donors who are 55 years of age or older to a special thank you event.

While the event focused on thanking these donors for their annual support, we also let them know of another way they can help the organization—by leaving a bequest in their will. Those that do, become a charter member of the Legacy Society.

06 | Providing Appropriate Recognition

When donors make really large gifts, you want to make sure that you have the creativity to steward those donors in special ways.

In one of my past lives, a former Board chair was termed out. As her final Board act, she made a rather large gift. She didn’t want anything named after her, nor did she want or, frankly, need a special reception. I didn’t need to take her out to dinner. We did that often enough. But we couldn’t just let the gift go uncelebrated. We decided to do something special at our gala, which was two and a half months away.

At that event we surprised our Board member with a video highlighting her service to our organization and with wonderful comments from her colleagues and former colleagues on our board, our staff, and—best of all— people her gift had directly or indirectly helped. She loved it.

Over the next several years, as we continued our active stewardship with her for all her past support, the video came up over and over again. When she made another significant gift she asked, “How are you going to top my video?”

STEWARDSHIP STEP #7:

For special gifts, make sure your stewardship strategies are also very special.

RECOGNIZING SMALLER DONORS

Public recognition for very large gifts must be specific to the donor. Often, large gifts are given in exchange for a naming opportunity. It may, as we just discussed, be recognized at an event. There are many ways to make one donor a star. But what about publicly recognizing a large group of donors who have made much smaller gifts?

The easiest and most inclusive public form of gratitude is a list of donors published in your newsletter, annual report, website, or all of the above.

Donors who give at a certain level, give in a certain way, are of a certain type (individual, corporate, foundation), or are members of a giving club, are generally grouped together.

I’ve often been asked, “What about the donor who gives anonymously?” I think it is important to show the size of your donor base, so I recommend that you list the gift, but only identify the donor as “Anonymous.” You may have several Anonymous donors in a category.

Each year when I published an honor roll, I would send what then was a printer’s blue line—today you send a PDF document—to donors on the list. I would circle their names and ask them to verify that this was the way they wanted their name(s) to appear. This was the main purpose of my contacting them. But most people did not just check their own names. They looked to see if their friends and peers were also on that list.

Not often, but often enough to justify my time, donors at one level would call and ask if they sent the gift immediately, could they be listed at a higher level. Usually, this was a level where someone they knew was listed.

STEWARDSHIP STEP #8:

Before you publicly announce a gift—in an honor roll or any other way-- ask for permission and check that you are recognizing them in a way that will please them.

CHECK PRESENTATIONS

A check presentation ceremony is a great way to publicly say thank you. The presentation can be a simple ceremony without a lot of fanfare, or it can be a full-blown three-ring circus. What matters is that it is appropriate to the gift and to the desires of the donors.

Corporate donors particularly like check presentations.

Work closely with their public relations departments on news releases and the like. Sometimes the corporation will also want to foot the bill for the event. They know that these gifts will, among other things, show them to be great corporate citizens.

DONOR WALLS

My husband sometimes teases me that at museums I spend as much time looking at the donor walls as I do at the art. Guilty as charged. I like to see who supports different organizations and the size of their support.

Donor walls and the like are actually usually thought of as techniques to raise money. For a gift of $X you get a plaque or a brick or a tile that’s of a certain size. Want it to be larger? Make a larger gift.

But it is also important to think about what you are going to do years from now to keep a donor happy. One of my clients, a director of a daycare center, had just such a dilemma. Ten years back, when the daycare center was being built, the donor wall was a great success. Instead of formal bronze plaques, they had shiny white tiles with colorful designs that looked like the children had painted them.

The campaign was a great success. The wall was covered. Complete.

But now, as funding was slowing down, and the building needed upgrades, the Director realized that she had woefully neglected these donors.

“I can’t go back to them after not having connected with them for almost a decade and ask for more money,” she told me. What to do?

I suggested a “Re-Dedication.” We spruced up space where the wall was located and invited back all the donors with their now much older children. The purpose of the event? Simply to once again thank these donors and show them how their gifts had grown over the years.

“Simply,” however, belies the real effort that went into reconnecting with these donors, getting at least some of them re-interested in the center, and finding ways to keep them involved.

STEWARDSHIP STEP #9:

Just because someone’s name is up on a wall for all to see, doesn’t mean that the donor will continue to feel close to you. You must continue to reach out to these supporters.

One nonprofit spotlight one of their donor wall people in each and every newsletter. It gives a reason to contact the donor before she writes the blurb (and it is a short 2-paragraph item with a picture of the wall plaque) and then afterward with a personal note attached to the article.

OTHER TYPES OF PUBLIC RECOGNITION

When someone makes a gift of $150, you may want to put that in your newsletter and you certainly will want to thank that person via an honor roll. When the gift is $150,000 you may want to provide a larger audience.

Getting an article in your local newspaper is a terrific way to publicly thank your donor, and not-so-incidentally get great PR for your organization. Don’t, however, lose sight of the main purpose: To shine a light on your donors’ generosity and the things their gift allows you to do.

Highlighting donors who support a particular program in any collateral materials for that project or program is another good way to recognize someone’s support. An appropriate recognition may be a full page with a picture in the brochure or it might be simply a line somewhere saying that “Support for this project comes from….”

Thanking someone in print is one way; thanking them in front of a live audience is another. At your annual gala, you may want to recognize a donor with an award where they get to come up to the podium and might even be able to say a few words.

Simply having the emcee or one of the speakers acknowledging their presence, thanking them for their support, and asking the audience to join in with their applause can also be a fantastic way to publicly say thank you.

07 | Regular Reporting On The Gift

Of all the donor retention strategies we’ve discussed, ensuring donors that their gift really was used as intended and that the project or program really is having the desired result is by far the most important.

DONOR BRIEFINGS

Letting donors know about the impact of their gift is a critical stewardship step, especially (but not exclusively) for larger donors. You can do this face to face or in writing.

Either way, it can be for one individual or a group of supporters.

Impact Reports are a terrific way to reach out to larger numbers of your donors. Sent out annually, semi-annually, or even quarterly, they tell your supporters what is going on at your organization and how charitable support has made a difference.

Newsletters can also be a great way to let all your donors know what is happening at your organization and how their support has made a difference. You can use the power of a newsletter to make a very specific statement by publishing a story about a very special gift.

Thanking your major donors in this way serves two purposes:

- It clearly shows the donors how important their gift is.

- It shows other potential major donors how their gifts would be valued.

Keeping donors informed both of fundraising results AND the results of fundraising is something every organization should do with some regularity. If something that was supported by fundraising is reported on in the newspapers, make sure to clip the article, copy it, and send it on with a personal note to all who made that something possible. Just as you cannot thank a donor too many times, you can give them enough feedback on the impact of their support.

STEWARDSHIP STEP #10:

As you communicate with and report back to your donors consider not just what you want them to hear but find out what they want to hear. And, who they want to hear from.

Should your letter be signed by you, the CEO, or the person most involved with the project they are supporting? Beyond who and what, ask yourself—or better yet, ask them—how do they want to hear from you?

BRINGING THE DONOR CLOSER

Sometimes, stewardship and cultivation feel like much the same side of a coin. In both, we are taking care of those who we believe have our organization’s interest at heart. These are people who have volunteered, made a gift, come to an event. We want to involve them more deeply in our organization and with our mission.

STEWARDSHIP IS THE MOST IMPORTANT STEP TO THE NEXT GIFT.

STEWARDSHIP STEP #11:

Fundraising is not something static where one thing happens and then…it’s over. It is a continuous loop where you are connecting and reconnecting with your supporters.

Personal meetings (in person, on the phone, via video conferencing), for example, are not just a technique to be used when you are trying to get a gift; they are useful when you are thanking someone for the gift or gifts they have already given.

What type of meeting or event will depend on:

- Your existing relationship with the donor

- The size of their gift

- The purpose of the gift

- The specific purpose of the meeting (thanks, recognition, peer pressure— yes, you may want others to see what their peer has done).

- What events are already taking place

- And here’s a biggie—what the donor has requested.

Very special gifts (as in those that are extremely large or gifts from long-time extremely generous donors) require very special get-togethers.

08 | Conclusion

Stewardship is too often the forgotten step in a development program. We focus so much on getting gifts we fail to remember that much of the important work happens after the donation is made.

A strong stewardship program creates so much value that it really is worth the extra effort. Among the outcomes you can expect are:

- Higher levels of donor retention.

- Greater success in moving donors up the giving ladder.

- Better percentages of pledge fulfillment.

- More future gifts as more donors put you in their wills

- Increased involvement by Board members and other volunteers.

- More positive word-of-mouth about your organization and the good work you do

More than all that, donor retention strategies assure that you are providing your supporters with important information that gives them clarity about your priorities.

This, in turn, encourages them to make gifts that are truly valuable and to give in ways that help you to meet your mission.

For more information on Donor Relationships and Acquisition, CLICK HERE!